If you’re wondering which savings account will earn you the most money, you’ve come to the right place! Saving money is important, but finding the right account can make a big difference. So let’s dive in and explore your options!

When it comes to choosing a savings account, there are many factors to consider. You want to find an account that offers high interest rates, low fees, and convenient access to your funds. But with so many choices out there, it can be overwhelming. Don’t worry, though, because we’re here to help you navigate through the savings account jungle!

In this article, we’ll break down the different types of savings accounts and give you tips on how to choose the one that will maximize your earnings. From traditional savings accounts to high-yield options, we’ll explore the pros and cons of each. So get ready to make your money work harder for you and start growing your savings!

Which Savings Account Will Earn You the Most Money?

In today’s ever-changing financial landscape, it’s important to make wise decisions when it comes to saving money. With so many savings account options available, it can be overwhelming to determine which one will provide the highest returns. From high-yield savings accounts to certificates of deposit (CDs) and money market accounts, each option offers its own unique benefits and considerations. In this article, we will delve into the world of savings accounts and explore which one can help you maximize your earnings.

High-Yield Savings Accounts: Unlocking the Power of Interest

When it comes to earning the most money from your savings, high-yield savings accounts are often a top contender. These accounts offer a higher interest rate than traditional savings accounts, allowing your money to grow at a faster pace. With a high-yield savings account, you can enjoy the benefits of compounding interest, where your earnings are reinvested, leading to even greater returns over time.

One of the key advantages of high-yield savings accounts is the flexibility to access your funds when needed. Unlike CDs, which have set terms, high-yield savings accounts typically do not have a withdrawal penalty. This means you can easily access your money in case of emergencies or unexpected expenses. However, it’s important to note that some high-yield savings accounts may have minimum balance requirements or monthly maintenance fees, so it’s essential to read the fine print before opening an account.

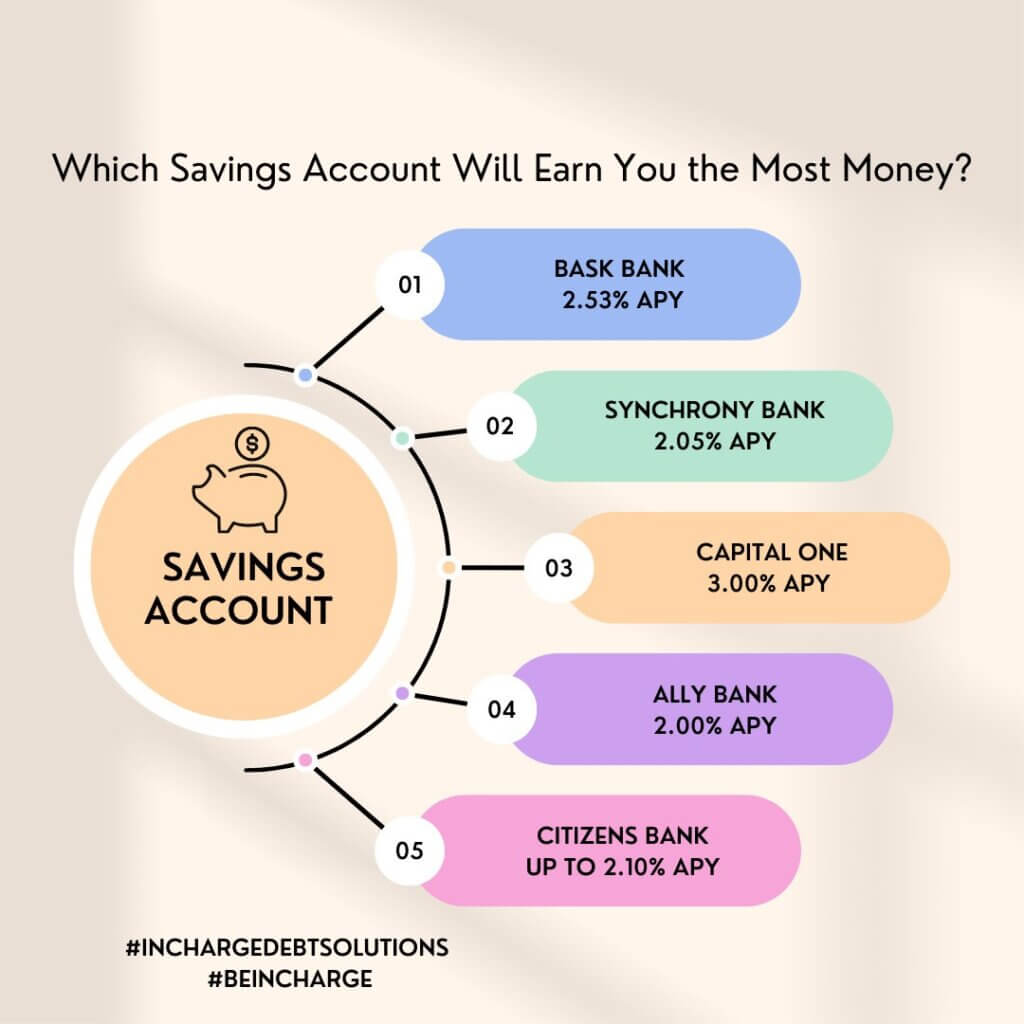

If you’re considering a high-yield savings account, it’s important to compare interest rates among different banks. Online banks often offer higher rates than traditional brick-and-mortar banks, as they have lower overhead costs. Additionally, some high-yield savings accounts provide introductory rates that may change after a certain period, so be sure to consider the long-term earning potential of the account.

Money Market Accounts: Balancing Access and Returns

Money market accounts (MMAs) are another popular option for savers looking to maximize their earnings. These accounts combine the benefits of savings accounts and checking accounts, providing a higher interest rate while still allowing easy access to your funds. Like high-yield savings accounts, MMAs offer competitive interest rates and the potential for compounding interest.

One advantage of money market accounts is the ability to write checks and make electronic transfers, giving you more flexibility in managing your money. MMAs also tend to have higher minimum balance requirements than regular savings accounts, which can help deter frequent withdrawals and encourage savers to maintain a higher balance. Some MMAs may also come with limited check-writing privileges or debit card access, providing even greater ease of use.

When choosing a money market account, it’s important to consider the fees associated with the account. Some MMAs have monthly maintenance fees or minimum balance requirements that, if not met, can eat into your overall earnings. Comparing different offerings from various banks can help you find the best money market account with the highest returns and the fewest fees.

Certificates of Deposit (CDs): Locking in Your Earnings

While high-yield savings accounts and money market accounts offer flexibility, certificates of deposit (CDs) provide a different approach to maximizing your savings. CDs are time-based accounts that offer fixed interest rates for a specified duration. By depositing your money into a CD, you agree to leave it untouched for the agreed-upon term, which can range from a few months to several years.

The main advantage of CDs is the higher interest rates they offer compared to regular savings accounts. With CD rates typically based on the duration of the term, longer-term CDs often provide higher returns. This makes CDs an attractive option for savers who don’t need immediate access to their funds and are willing to lock in their money for a set period.

Another benefit of CDs is the security they offer. Unlike investing in the stock market or other investment vehicles, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank. This provides peace of mind knowing that even if the bank fails, your funds are protected.

Before choosing a CD, it’s important to consider the term length that aligns with your financial goals. Longer terms generally offer higher interest rates, but they also mean your money will be inaccessible for a longer period. Additionally, keep an eye out for any penalties associated with early withdrawal from a CD, as they can vary depending on the bank and the specific terms of the account.

Choosing the Right Option for You

When it comes to selecting the savings account that will earn you the most money, there is no one-size-fits-all answer. It ultimately depends on your financial goals, risk tolerance, and liquidity needs. High-yield savings accounts, money market accounts, and certificates of deposit all offer unique advantages and considerations.

Here are some key points to keep in mind:

1. Determine your financial goals: Are you saving for a short-term goal, such as a vacation, or a long-term goal, such as retirement?

2. Consider your risk tolerance: Are you comfortable locking your money into a CD for a set period, or do you prefer the flexibility of a high-yield savings account or money market account?

3. Assess your liquidity needs: Will you need access to your funds in case of emergencies or unexpected expenses, or can you afford to keep your money locked away in a CD for a specific term?

4. Compare interest rates and fees: Research different banks and financial institutions to find the best rates and lowest fees for the type of account that aligns with your goals.

By carefully evaluating these factors and considering your individual circumstances, you can make an informed decision and choose the savings account that will best help you maximize your earnings. Remember, it’s essential to regularly review and reassess your financial goals to ensure your chosen account continues to align with your needs. Happy saving!

Key Takeaways: Which Savings Account Will Earn You the Most Money?

- 1. Look for high-interest rates: Choose a savings account with the highest interest rate to maximize your earnings.

- 2. Consider compound interest: Opt for savings accounts that offer compounding, as it can significantly boost your savings over time.

- 3. Compare fees and charges: Be aware of any fees or charges associated with the savings account, as they can eat into your earnings.

- 4. Look for promotional offers: Keep an eye out for special promotions or introductory offers that can provide additional earning opportunities.

- 5. Consider account accessibility: Find a savings account that offers convenient access to your funds while still providing competitive interest rates.

Frequently Asked Questions

When it comes to savings accounts, everyone wants to make the most money they can. To help you navigate through the options, here are some commonly asked questions about finding the best savings account to maximize your earnings.

1. What factors should I consider when choosing a savings account?

When choosing a savings account, you should consider interest rates, fees, accessibility, and account features. Look for an account with a high-interest rate, no monthly fees, easy access to your funds, and additional features like mobile banking or automatic transfers.

It’s also important to consider the financial institution’s reputation, stability, and customer service. Online reviews and ratings can provide valuable insights into the overall customer experience.

2. How do interest rates affect how much money I earn in a savings account?

The interest rate is a crucial factor in determining how much money you can earn in a savings account. The higher the interest rate, the more your money will grow over time. For example, a savings account with a 2% interest rate will earn you more money than one with a 0.5% interest rate.

Compounding plays a significant role as well. Compound interest allows you to earn not only on the original amount you deposit but also on the interest you’ve already earned. As a result, your savings can grow faster, especially if the interest is compounded frequently, such as daily or monthly.

3. Are there different types of savings accounts and which one is the most profitable?

Yes, there are different types of savings accounts, such as basic savings accounts, money market accounts, and certificates of deposit (CDs). The most profitable can vary depending on your financial goals and available funds.

Basic savings accounts offer higher liquidity and easier access to your money but may have lower interest rates. Money market accounts typically have higher interest rates but often require a higher minimum deposit and may have limited check-writing privileges. CDs generally offer the highest interest rates but require you to lock your money away for a fixed period of time.

4. Can switching to a different savings account increase my earnings?

Switching to a different savings account can potentially increase your earnings. If you find a savings account with a higher interest rate or better terms, it may be worth considering a switch. However, it’s essential to carefully evaluate any fees or penalties associated with closing your current account and opening a new one.

Before making a switch, calculate the potential earnings based on the new account’s interest rate and compare it with what you’re currently earning. Additionally, consider the convenience and features of the new account to determine if it aligns with your needs and financial goals.

5. Are online savings accounts a good option for maximizing earnings?

Yes, online savings accounts can be a great option for maximizing earnings. Online banks often have lower overhead costs compared to traditional brick-and-mortar banks, allowing them to offer higher interest rates on savings accounts. Additionally, many online savings accounts have no monthly fees or minimum balance requirements.

While some people may have concerns about the lack of physical branches, most online banks provide excellent customer service and easy access to funds through online and mobile banking platforms. Just ensure you choose a reputable online bank with FDIC insurance to safeguard your deposits.

Which Savings Account Will Earn You The Most Money?

Summary

So, let’s recap what we’ve learned about savings accounts. Different banks offer different interest rates. That’s the extra money the bank gives you for keeping your money with them. The more money you have and the longer you keep it in the account, the more interest you’ll earn. But be careful, some accounts have fees that can eat into your earnings. So make sure to compare your options and choose the account that will help you save the most money in the long run. Happy saving!